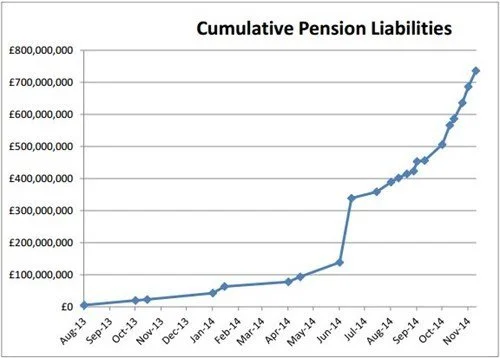

MorganAsh PLUS buy-outs tops over £700 million of pension liabilities

The MorganAsh pension longevity underwriting service – for medically underwritten buy-outs – tops over £700 million of pension liabilities.

In 2013, MorganAsh launched the pension longevity underwriting service (PLUS) to evaluate individual scheme members of defined benefit pension schemes to establish their health and expected mortality status for evaluation and use in pension buy-out transactions. The medically underwritten de-risking market is growing significantly and MorganAsh has just passed the £700 million mark.

MorganAsh has agreed processes with four participating insurers: Aviva, Just Retirement, Legal & General and Partnership.

MorganAsh operates an independent medical information collection and underwriting service and provides this on a secure portal, for the participating insurers to use in their tenders.

Participation by pension scheme members in the medical underwriting exercise has been higher than expected which has ensured there are material numbers of respondents to allow evaluations of the overall scheme liabilities. Over 6,000 scheme members have been assessed to date.

Commenting on the success of the service, Andrew Gething, MorganAsh’s managing director, said: “We collect independent information on the individuals within a scheme, to enable insurance companies to determine improved mortality estimates. All the assignments we have undertaken have led to a completed transaction for the trustees, with savings around the 10% mark.”

James Mullins, head of buy-in solutions at Hymans Robertson, said: “We have had great experience with the MorganAsh medical underwriting service and it is a vital component in growing the bulk annuity market.”

Neil Rogers, bulk annuity consultant at Mercer Limited, added: “We are seeing increasing enthusiasm amongst trustees and sponsors of moderately sized pension schemes to integrate medical underwriting into their bulk annuity purchase exercises. A coordinated and consistent approach is therefore crucial and we welcome MorganAsh’s efforts to develop and refine such an approach in conjunction with a number of insurers.”

Costas Yiasoumi, from Partnership, added, “The overall growth in medically underwritten bulk annuity activity this year has been considerable, not surprising given the improved pricing this can bring. Effective data collation from pensioners is crucial – MorganAsh’s activity in this area can only help support further market growth.”

Tim Coulson, director of defined benefit solutions at specialist insurer Just Retirement, said; “The MorganAsh PLUS service has created robust outputs that have accelerated confidence amongst consultants in the medically underwritten de-risking market. This has resulted in a significant rise in the number of consultants participating in the market during the last year.”